Let’s Chat Mortgage Rates with GR Mortgages!

Hey there, Ontario! Welcome to GR Mortgages, where we’re all about hooking you up with the best mortgage rates around—whether you’re in the buzz of Toronto, the cozy corners of Brampton, or the quiet charm of Belleville. Buying a home, refinancing, or renewing your mortgage? We know it can feel like a lot, but we’re here to keep it simple, friendly, and—yep—easy on your wallet. We’re ready to help you find a deal that works for you, no stress required!

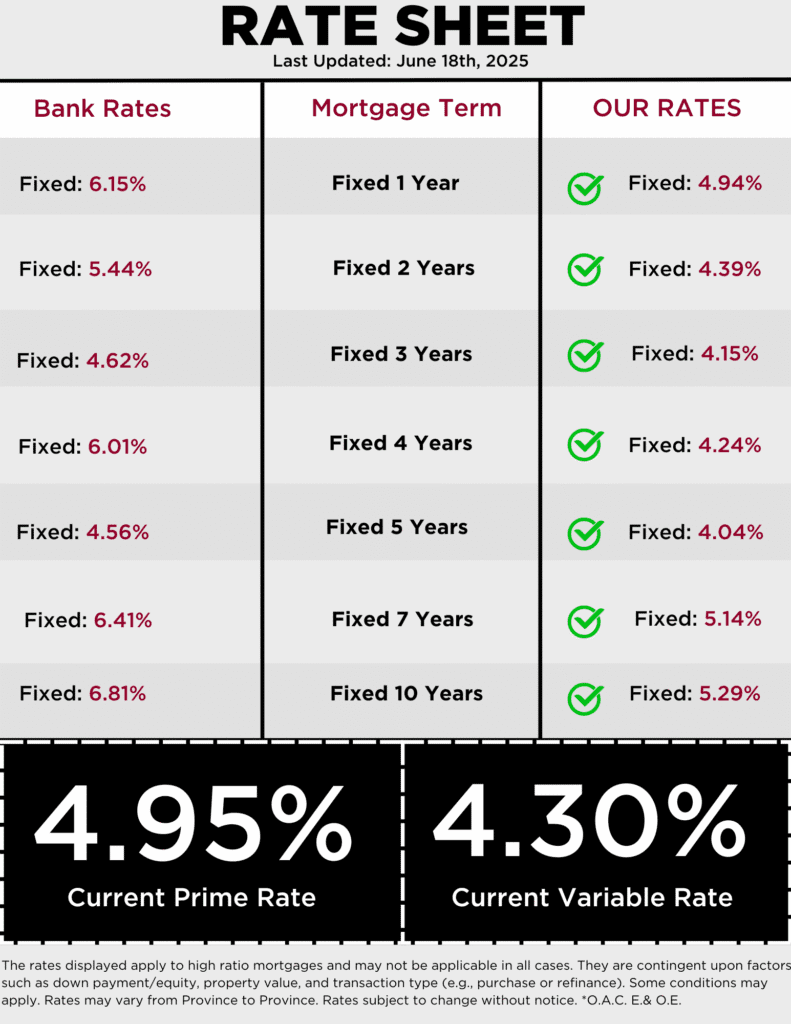

Mortgage rates? They’re the big deal that decides what you’re paying every month and down the road. At GR Mortgages, we’re laser-focused on finding you options that save you money, whether you’re eyeing a condo in Ottawa, a house in Hamilton, or something sweet in Kingston. Fixed rates for the planners, variable rates for the go-with-the-flow folks—we’ve got it all, customized for wherever you’re at in Ontario.

What We’re Offering Today

Imagine this: you’re hunting for rates, and GR Mortgages pops up with options that just click. Love knowing exactly what’s coming? Our fixed-rate mortgages keep things steady, perfect for long-term vibes in places like Toronto or Mississauga. More of a roll-the-dice type? Variable-rate mortgages give you flexibility, especially in fast-moving spots like Brampton. We’ve even got shorter-term choices—think 1-year or 3-year—if you’re in Belleville or London and like to keep your options open.

Why pick us? We’re not some giant bank pushing whatever’s handy. We’re out there every day, working with lenders across Ontario to dig up deals you won’t stumble on solo. Refinancing in Sudbury? Buying your first place in Brampton? We’ve got the know-how to make it happen without breaking the bank.

Why Rates Are a Big Deal in Ontario

Let’s get real for a sec: Ontario’s housing scene is all over the map. Toronto’s got homes topping a million bucks easy. Brampton’s creeping up near $900,000. Then there’s Belleville, where you can still grab something around $500,000. A little tweak in your rate—like a dip from high to low—can mean thousands saved over time. That’s more cash for fixing up your place, hitting the road, or just chilling out. At GR Mortgages, we’re all about finding you that extra breathing room, no matter where you’re calling home.

In Hamilton, where prices are on the rise, a solid fixed rate locks you in nice and tight. Ottawa, with its busy streets? A variable rate might give you an edge if things shift. Wherever you are, we’re here to find what fits.

It’s All About You

Here’s the scoop: we don’t do one-size-fits-all at GR Mortgages. You’re not just another file. Buying your first home in Windsor? Refinancing in Thunder Bay to shake off some debt? Renewing in Kingston because it’s time? We listen, figure out what you’re after, and then dig through lender options—banks, credit unions, you name it—to land you something perfect.

First-time buyer in Toronto? We’ll get you pre-approved so you’re ready to roll. Refinancing in Brampton? We’ll tap into your equity with a deal that feels right. Renewal coming up in Belleville? Don’t just nod at your bank’s offer—let us hunt down something better. Think of us as your mortgage buddy, minus the awkward hugs.

We’ve Got Ontario Covered

We love serving up solutions all over this province. Toronto’s big-city energy? We’re on it. Brampton’s growing neighborhoods? Got you. Belleville’s chill pace? Absolutely. From Ottawa’s hustle to Hamilton’s gritty charm, we know what each spot needs—and how to save you money there. Mississauga, London, Sudbury—you’re all in our wheelhouse.

How We Score You the Good Stuffb

So, how do we pull this off? Simple—we’ve got the connections. Handling tons of clients means lenders cut us deals, and we pass those savings straight to you. No middleman nonsense—just straight-up good rates. See a better offer out there? Let us know, and we’ll either top it or make it worth sticking around. That’s how we roll, from Windsor to the GTA.

Let’s Get Started!

Ready to dive in? Reach out online or give us a shout. We’re here with open ears (and awesome rates). Buying, refinancing, renewing—whatever’s on your plate, GR Mortgages has the smarts and the options to make it smooth. Let’s get you into that dream home—or save you some dough—starting right now!

Your Mortgage, Our Priority

Stressed About Your Mortgage Renewal? New Rules & Tips to Save Across Canada

Is your Mortgage Renewal sneaking up, and you’re starting to feel that little twinge of…

In 2025, Should You Pick a Variable Mortgage Rate?

The topic of whether to get a variable rate mortgage has grown more important as…

Why Refinancing Your Mortgage Makes Sense Right Now | Refinance Mortgage

Understanding Refinancing and Refinance Mortgage Why Refinance Mortgage? Understanding the Benefits of a Refinance Mortgage…

How to Increase Your Mortgage Pre approval Amount: Tips for a Higher Approval

Understanding Mortgage Preapproval A mortgage preapproval is an evaluation by a lender that determines how…